lakewood co sales tax rate

Also not included are title registration tag governmental fees electronic filing charges excluding CO any emissions testing andor state inspection fees transfer fee and any finance charges if applicable. The Metropolitan Atlanta Rapid Transit Authority MARTA ˈ m ɑːr t ə is the principal public transport operator in the Atlanta metropolitan areaFormed in 1971 as strictly a bus system MARTA operates a network of bus routes linked to a rapid transit system consisting of 48 miles 77 km of rail track with 38 train stationsMARTAs rapid transit system is the eighth-largest.

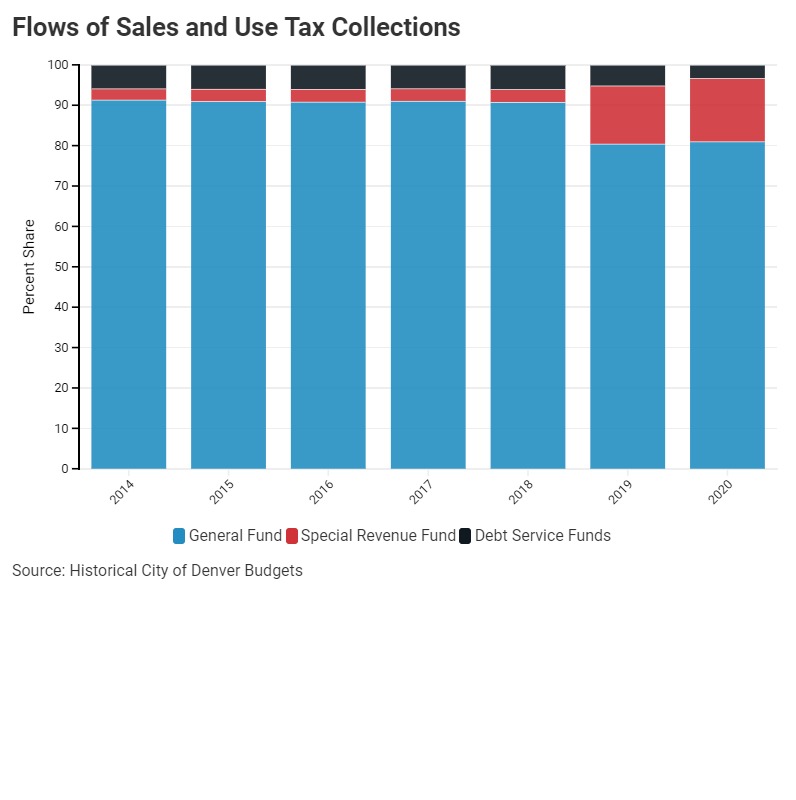

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

PIF is not a tax of the City.

. We would like to show you a description here but the site wont allow us. Tax and license not included. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Public Improvement Fees PIF may also be imposed in certain areas of the city. Available at Everett location. 111720 - 1 - Location SalesUse Tax CountyCity Loc.

1401 0258 0650908 Adams County. Sales shipped into Belmar are subject to the standard 3 Lakewood sales tax rate 75 Combined Total. 1 240746 Set Scale.

There is no applicable county tax. View our selection of Used vehicles for sale in Lakewood CO. The total sales tax rate in any given location can be broken down into state county city and special district rates.

If you live in the Tacoma Lakewood WA area and have been turned down for a car loan in the past dont worry CarHop will work hard to get you approved and driving even if you have bad or no credit. Learn more about transactions subject to Lakewood salesuse tax. Assessmentscomchenryilus For maximum performance the lowest level recommended browser for this application is Internet Explorer 90.

The 881 sales tax rate in Denver consists of 29 Colorado state sales tax 48099 Denver tax and 11 Special tax. For tax rates in other cities see Colorado sales taxes by city and county. Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community.

But Lakewoods local tax is about 7 percent lower than Denvers. Shavano Park officials said financing a voter-approved street program could include a mix of a 001 hike in the debt service portion of. The application is also compatible with Firefox Chrome and Safari.

Special annual percentage rate APR with approved credit and not. Price includes all costs to be paid by a consumer except for licensing costs registration fees and taxes. Department of Planning Development McHenry County Illinois Scale.

According to co-owner Colin Weynand. Code Local Rate State Rate Combined Sales Tax 1 A Eff. Lakewood CO 80226 MAIN.

You can print a 881 sales tax table here. Our tax rate is 19 percent instead of the 26 percent you get hit with down the street in. Expires June 30 2022.

Find the best prices for Used vehicles near Lakewood. California has a 6 sales tax and Los Angeles County collects an additional 025 so the minimum sales tax rate in Los Angeles County is 625 not including any city or special district taxes. This table shows the total sales tax rates for all cities and towns in Los.

Other Lakewood Taxes City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Use Tax City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Other Lakewood Taxes City Of Lakewood

States With Highest And Lowest Sales Tax Rates

How Colorado Taxes Work Auto Dealers Dealr Tax

Business Licensing Tax City Of Lakewood

Why Do U S Sales Tax Rates Vary So Much

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Washington Sales Tax Guide For Businesses

Ohio Sales Tax Guide For Businesses

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute