who pays sales tax when selling a car privately in texas

Private car sales are still taxed 625 in Texas but it is calculated from the purchase price or standard presumptive value SPV whichever is higher. Car Sales Tax on Private Sales in Taxes.

Is Buying A Car Tax Deductible Lendingtree

You do not need to pay sales tax when you are selling the vehicle.

. If you own a car whether you purchased it new from a dealer or used from a private seller theres a 99. If the buyer is living in another state then the tax would need to be paid in that state not in Texas. There are two certainties in life as the saying goes.

When Who pays sales tax when selling a car privately in Texas. Motor vehicle sales tax is the purchasers responsibility. Once the buyer has the vehicle.

The seller paid sales tax when they bought the car so they only pay income tax on. Motor vehicle sales tax is the purchasers responsibility. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer.

Multiply the vehicle price after trade-in andor incentives by the sales tax fee. The buyer will have to pay the sales tax when they. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Who pays sales tax when selling a car privately in Texas. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. When Who pays sales tax when selling a car privately in Texas.

If the seller is not a Texas licensed dealer the purchaser is. Driving in Back Bay ShutterstockRelated GuidesSales and Use TaxMotor Vehicle. Its added to the initial cost of registration.

Toyota of Naperville says these county taxes are far. If the seller is not a Texas licensed dealer the purchaser is responsible for titling and registering the vehicle as well as paying the. However you do not pay that tax to the car dealer or individual selling the.

If I sell my car do I pay taxes. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or.

The buyer pays sales tax on the purchase price of the car. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply.

One thing you do need to make sure gets done though is a vehicle transfer. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Private Party Vehicle Registration

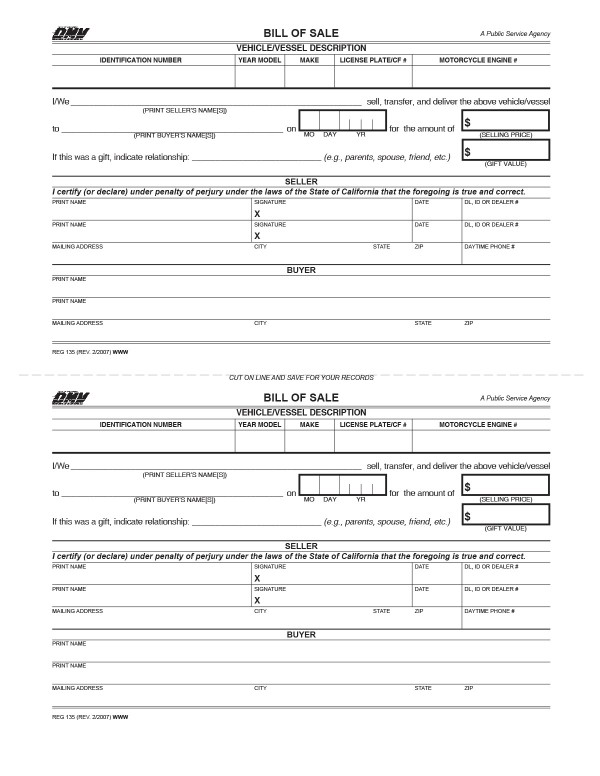

All About Bills Of Sale In California The Facts And Forms You Need

Sales Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

Ohio Sales Tax Small Business Guide Truic

General Sales Taxes And Gross Receipts Taxes Urban Institute

How To Fill Out A Car Title In Texas Where To Sign When Selling Car Youtube

How Much Is Tax Title And License In Texas The Freeman Online

Motor Vehicle Information Fort Bend County

Bill Of Sale Form Free Bill Of Sale Template Us Lawdepot

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

8 Tips For Buying A Car Out Of State Carfax

Texas Car Sales Tax Everything You Need To Know

How To Sell A Car Privately In Texas Topmarq

Selling Your Car Privately Or To A Dealer What S Better Orr Chevrolet Of Fort Smith Blog